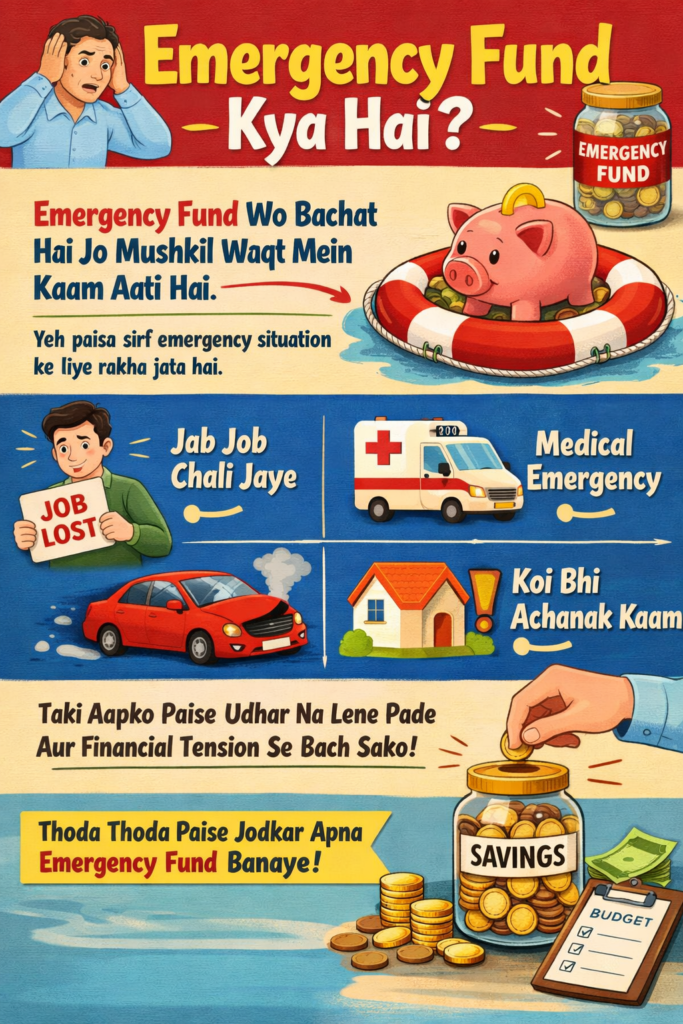

Emergency fund kya hai? ye ek aisa savings fund hota hai jo unexpected situstions jaise medical emergency, job loss ya urgent expenses me kaam aata hai

Aksar hum sochte hain ki sab kuch planned hai – job chal rahi hai, income aa rahi hai, bills time par pay ho jaate hain. Lekin life hamesha plan ke hisaab se nahi chalti. Kabhi medical emergency aa jaati hai, kabhi job related issue, aur kabhi family ki koi sudden need. Yahin par emergency fund ka role start hota hai.

emergency fund kya hai ye samajhna har salaried aur self-employed person ke liye bahut zaroori hota hai.

Agar aap genuinely apni financial life ko secure banana chahte ho, toh emergency fund banana koi option nahi, balki zaroorat hai. Is article mein main bilkul normal, human Hinglish language mein samjhaunga ki emergency fund kya hota hai, kyun zaroori hai, aur aap ise realistically kaise bana sakte ho – bina pressure aur bina confusion ke.

agar aapko clear nahi hai emergency fund kya hai, to financial planning incomplete rah jaati hai.

“Agar aap beginner ho to emergency fund kya hai samajhna bahut zaroori hai.”

Table of Contents

Emergency Fund Kya Hota Hai? (Simple Samjho)

“Ab hum detail me dekhenge emergency fund kya hai aur ise kaise banaye.”

Emergency Fund Ka aarth hota hai aisa paisa jo sirf emergency me hi istemal kiya jata hai. Joh daily kharch, shopping, festivity ya travel me istemal nahi hota.

Seedhi baat mein:

Emergency fund = Jab life aapko surprise de, tab kaam aane wala paisa

Iska main kaam yeh hota hai ki jab situation control ke bahar ho jaaye, tab aap loan ya credit card ke chakkar mein na pado.

Emergency Fund Kyun Itna Important Hai?

Bahut log sochte hain ki “abhi toh sab theek hai”, lekin problem yeh hai ki emergency kabhi warning dekar nahi aati.

Kuch real-life situations:

- Achaanak hospital ka kharcha

- Job chali jaana ya salary delay hona

- Ghar ka AC, fridge ya bike kharab ho jaana

- Family mein koi urgent situation

Agar emergency fund nahi hota, toh zyada tar log:

- Credit card use kar lete hain

- High-interest personal loan le lete hain

- Apni long-term savings tod dete hain

Yeh teenon cheezein future ko aur zyada risky bana deti hain.

Savings Aur Emergency Fund Same Kyun Nahi Hain?

Yeh beginners ki sabse common confusion hoti hai. Savings aur emergency fund sunne mein similar lagte hain, lekin dono ka kaam alag hota hai.

- Savings: Travel, shopping, goals ke liye

- Emergency fund: Sirf crisis ke liye

Emergency fund ko aap mentally bhi alag treat karte ho. Is paison ko dekh kar yeh feel nahi aani chahiye ki “isko use kar lete hain”.

Kitna Emergency Fund Banana Chahiye?

General guideline yeh kehti hai:

👉 3 se 6 months ke essential expenses

Example se samajhte hain:

Agar aapke monthly zaroori kharche ₹18,000 hain:

- 3 months = ₹54,000 (minimum)

- 6 months = ₹1,08,000 (ideal)

Agar yeh amount aapko zyada lagta hai toh tension mat lijiye . Emergency fund race nahi hai, process hai.

Emergency Fund Banana Kaise Start Karein? (Practical Steps)

Step 1: Apne Essential Expenses Likho

Sabse pehle yeh clear karo ki bina kin cheezon ke aap survive nahi kar sakte:

- Rent

- Khana

- Bijli, pani

- Travel

Iska monthly total nikaalo.

Step 2: Chhoti Amount Se Start Karo

Bahut log isliye start hi nahi karte kyunki amount bada lagta hai. Sach yeh hai ki:

- ₹500 ya ₹1000 se bhi start karna perfectly okay hai

Important yeh nahi hai ki kitna, important yeh hai ki regular ho.

Step 3: Alag Jagah Rakho

Emergency fund ko:

- Daily savings account se alag rakho

- Easily withdraw ho sake, lekin daily nazar ke saamne na ho

Step 4: Salary Aate Hi Save Karo

Best habit yeh hoti hai ki jaise hi salary aaye, emergency fund ka paisa pehle side mein chala jaaye. Bacha hua paisa kharch ke liye hota hai.

Step 5: Sirf Emergency Mein Hi Use Karo

Sale, discount ya festival emergency nahi hote. Agar emergency fund ko galat jagah use kar liya, toh iska purpose hi khatam ho jaata hai.

Emergency Fund Kahan Rakhein?

Emergency fund ka goal hota hai safety aur quick access, high return nahi.

Safe options:

- Normal savings account

- Liquid mutual funds

- Short-term FD

Avoid karo:

- Stocks

- Crypto

- Long-term lock-in investments

RBI bhi financial safety ke liye emergency savings ko important maanta hai.

Bahut se log poochte hai emergency fund kya hai aur iske bina life me kaise risk badh jata hai.

Beginners Ke Liye Emergency Fund Game Changer Kyun Hai?

Jab aapke paas emergency fund hota hai:

- Aap mentally relaxed rehte ho

- Job loss ka dar kam hota hai

- Investment decisions better hote hain

- Credit card par dependency kam hoti hai

Yeh ek silent confidence deta hai jo dikhta nahi, par feel hota hai.

Common Mistakes Jo Log Karte Hain

- “Baad mein bana lenge” sochna

- Emergency fund ko shopping mein use karna

- Bahut risky jagah invest kar dena

- Perfect amount ka wait karna

Yaad rakho: Perfect timing kabhi nahi aati.

Emergency Fund Ke Baad Kya?

Jab aapka emergency fund ready ho jaata hai, tab aap:

- SIP confidently start kar sakte ho

- Long-term investments plan kar sakte ho

- Financial goals bina dar ke set kar sakte ho

Emergency fund ek strong foundation hota hai, bina foundation ke building khadi nahi hoti.

Aaj ke time me emergency fund kya hai ye samajhna har earning person ke liye bahut important ho gaya hai, kyuki bina planning ke financial problems aa sakti hai.

Final Thoughts (Dil Se)

Emergency fund koi boring topic nahi hai, yeh aapki peace of mind ka insurance hai. Jab life tough ho jaati hai, tab yahi fund aapke saath khada hota hai.

Agar aap sach mein apni financial life improve karna chahte ho, toh emergency fund ko seriously lo. Chhota start karo, lekin aaj se karo.

Is article ka main goal ye batana hai ki emergency fund kya hai aur beginner ise step by step kaise bana sakte hai.

Agar aap budgeting ke baare me aur jaana chahte ho to hamara 50/30/20 rule explained article bhi zaroor padhe.